As cryptocurrencies continue to gain popularity and rise in value, day trading has become an increasingly popular way for investors to make profits. However, interpreting cryptocurrency charts can be a daunting task, especially for those who are new to the world of finance and investing.

Understanding the Basics of Cryptocurrency Charts

Before we dive into the intricacies of interpreting cryptocurrency charts, it is important to understand what they are and how they work. At its most basic level, a cryptocurrency chart is a visual representation of the price of a particular asset over time.

These charts can be used to track the performance of a cryptocurrency over a specific period, such as an hour, day, week, or month.

There are several different types of cryptocurrency charts that you can use for day trading, including line charts, candlestick charts, and bar charts. Each type of chart has its own unique features and is better suited to certain types of analysis. In this article, we will focus on line charts and candlestick charts, as they are the most commonly used types of charts in the world of cryptocurrency trading.

Line Charts for Cryptocurrency Trading

A line chart is a type of chart that displays the price of an asset over time as a series of connected points. These points are usually plotted on a two-dimensional graph, with the x-axis representing time and the y-axis representing the price of the asset in question.

One of the key benefits of line charts is that they allow you to easily see trends and patterns in the data. For example, if the price of a cryptocurrency is consistently increasing over a period of time, this may indicate that the asset is experiencing a bullish trend.

Conversely, if the price of a cryptocurrency is consistently decreasing over a period of time, this may indicate that the asset is experiencing a bearish trend.

In addition to trends and patterns, line charts can also be used to identify support and resistance levels. Support levels are prices at which the price of an asset has historically found a floor, while resistance levels are prices at which the price of an asset has historically found a ceiling.

By identifying these levels, you can use them to make informed decisions about when to buy or sell a cryptocurrency.

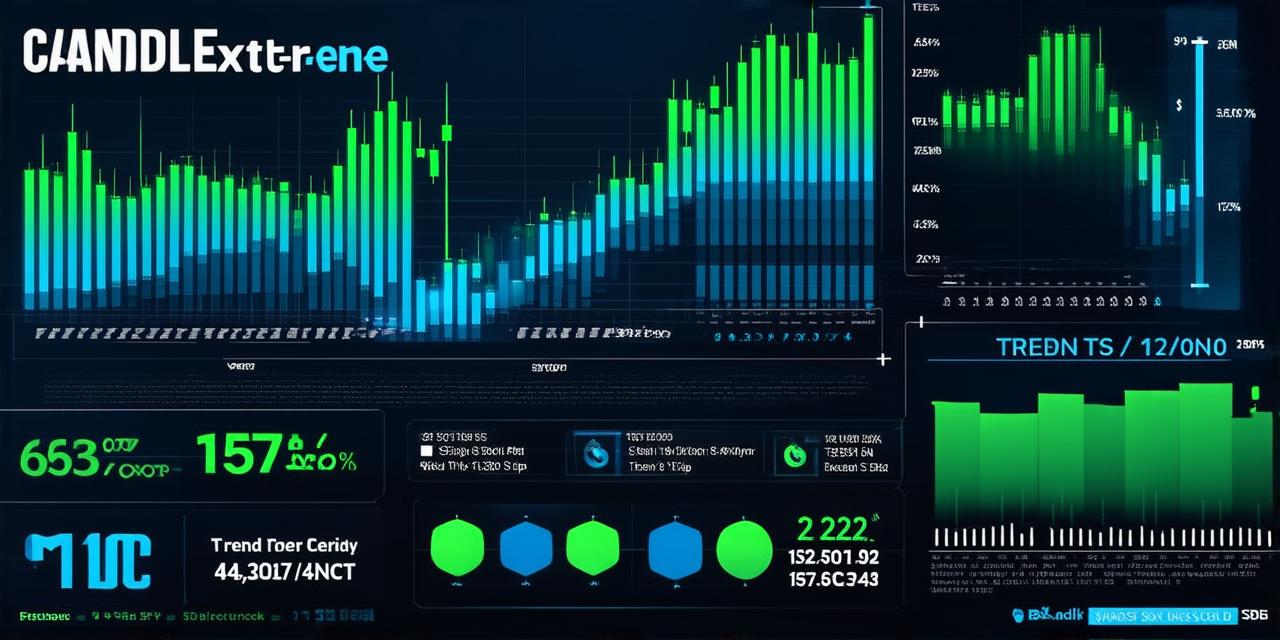

Candlestick Charts for Cryptocurrency Trading

A candlestick chart is a type of chart that displays the price of an asset over time as a series of rectangular shapes, known as “candlesticks”. These candlesticks are typically color-coded, with green candlesticks indicating a bullish trend and red candlesticks indicating a bearish trend.

Candlestick charts are similar to line charts in that they allow you to see trends and patterns in the data. However, they provide additional information that can help you make more informed decisions about when to buy or sell a cryptocurrency.

For example, candlestick charts include information about the opening price, closing price, high price, and low price of an asset over a specific period of time. This information can be used to identify key levels of support and resistance, as well as potential areas of breakout or consolidation.